“So if higher prices leads to more demand, which feeds into higher prices, what’s to say this cycle can’t continue indefinitely?”

Well, the cycle of rising prices can, and did, continue longer than most of us (including myself) imagined. But for the housing market to keep rising beyond wages and rental growth, there needs to be ever-increasing debt and a never-ending stream of new buyers. Both of these have limits.

At some point, everyone who is going to get on-board the boom will have done so. And those who are buying multiple properties will, at some stage, reach their limit of risk.

And when these limits are reached, prices plateau. But after a boom, prices can’t plateau for long because when they do, the feedback loop starts to works in reverse. Here's how:

Fear

For speculators, greed turns to fear when prices stop rising. Investors who are getting a sub-5% rental return (a loss after expenses) are relying on capital growth to make the investment worthwhile. So when prices plateau, fewer investors are tempted to buy, and many start to sell.

During the boom, first-home buyers are driven by the fear of being priced out of the market if they delay. However, when prices flat-line or start to fall slightly, this pressure is taken off. Many will take the opportunity to save a larger deposit in order to reduce the interest bill and avoid paying Lender’s Mortgage Insurance. This reduces demand and has the effect of further reducing house prices.

Incorrect forecasts

While prices are going up, it’s very hard to imagine them ever falling. Then, when they flat-line, people assume they will remain flat for a while. But as I explained in Will property prices plateau, this expectation of flat prices is itself enough to reduce demand. As prices start falling in earnest, despair grows and people start to believe (again incorrectly) that house prices will never recover.

Falling equity

As the value of property goes down, people have less (or no) equity to borrow against in order to fund the purchase of a holiday home or an investment property.

Weaker economy

As home-owners’ equity is eroded, they feel poorer and the wealth effect starts to work in reverse. People spend less and focus their efforts on paying down debt in order to avoid going into negative equity – the uncomfortable situation where you owe the bank more than your house is worth.

Here in Australia, we can’t simply walk away from our mortgages, like they could in many US states. Property bulls often cite this as a reason why our prices will not crash. And I agree this might support house prices in initially. However, by definition, it means we will be stuck paying off our super-sized mortgages for years. As a result, the economy will suffer and jobs will be lost, resulting in forced sellers and more risk-adverse buyers.

Banks

During the boom, banks continually reduce their deposit requirements to ensure a steady stream of new buyers. However, when falling prices become more obvious, banks will need to increase their deposit requirements for fear of being unable to recover their money in case of default (mortgage insurance only covers them for a loss of up to 20%). As deposit requirements rise, the amount someone has available to bid on a house comes down – exponentially.

Other vested interests

Even real-estate agents contribute to falling prices while the bubble is bursting. For real-estate agents, a sale is more important that getting a good price. So, when buyers are scarce, real-estate agents subtly lower the expectations of their clients, encouraging them to “meet the market” if they want to make a sale.

Of course, the media also do their bit on the way down – this time selling papers with headlines of doom and gloom.

* * *

With falling auction clearance rates, rising stock on the market, record low growth of housing credit and flat or falling house prices, it seems as though Australia’s debt-fuelled binge has come to an end. If this is true, the process outlined above is just getting started.

Many other countries took their cue that the party was over during the GFC and started the process of deleveraging. Australians, however, kept partying into the early hours of the morning. But we won’t be exempt from the bursting of the biggest global asset bubble in history. We didn’t avoid the GFC; we delayed it. And the resulting hangover will be even worse as a result.

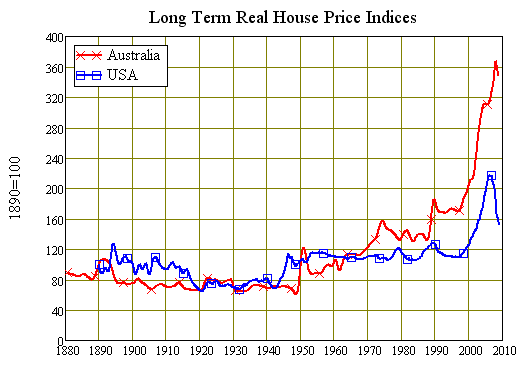

As shown in the above chart, our property bubble dwarfs the America one. I predict the bursting of the bubble – falls of at least 40% over around 7–8 years – will be painful, especially for those who have based their decision to buy on the flawed assumption that house prices always go up.

Taxpayers will also be on the hook, funding bailouts of the institutions that are considered “too big to fail”. The crash will be accompanied by a deep recession as households focus on paying back debt for many years to come. Businesses will close and many people will lose their jobs.

But this is the unpleasant-tasting medicine that we must take in order to get our economy on a more sustainable footing, an economy where money and effort is directed towards production rather than speculation, and an economy that does not thrive on the ridiculous habit of paying each other more and more for the same thing and celebrating the fact.

Taxpayers will also be on the hook, funding bailouts of the institutions that are considered “too big to fail”. The crash will be accompanied by a deep recession as households focus on paying back debt for many years to come. Businesses will close and many people will lose their jobs.

But this is the unpleasant-tasting medicine that we must take in order to get our economy on a more sustainable footing, an economy where money and effort is directed towards production rather than speculation, and an economy that does not thrive on the ridiculous habit of paying each other more and more for the same thing and celebrating the fact.

Comments welcome.

Cheers,

Andy.

Interesting read, but you cite a common misconception regarding the role of non-recourse loans in the US property crash.

ReplyDeleteWhilst those loans give home owners the opportunity to hand back the keys to the bank without having to pay the balance of the outstanding loan, that of itself gives rise to tax consequences under US laws. In those circumstances forgiveness of the loan is treated as indirect income which is taxable.

So rather than banks bankrupting individuals for failure to make their mortgage repayments, you have the RIA bankrupting them instead for failing to pay the tax which has arisen as a result of them walking away from the loan.

http://realestate.msn.com/article.aspx?cp-documentid=13108456

Ultimately the same consequence ensues.

Apologies, reference to RIA was meant to be IRS.

ReplyDeleteThanks Mr Bubbles, I was not aware of that.

ReplyDeleteBut still, if you’re underwater say $200,000 in your mortgage in Australia, the bank will come after you for $200,000. In American non-recourse states, the IRS will come after you for 10% to 35% of $200,000 (depending on your income).

That’s quite a big difference. But I agree with you that the end result will be the same.

Great blog, found this linked from the Aussie property forum today. If one things certain, this crazy escalation in house prices can't go on. Most of my mates who own homes freely admit there maxed out and they're preying for interest rate cuts, I'm not joking!

ReplyDeleteAndy, you are right regarding the size of the liability of negative equity versus a tax liability arising on income.

ReplyDeleteHowever, given the nature of subprime borrowers I doubt in most cases their capacity to repay a lump sum $20,000 to $60,000 tax debt would be any better than their ability to keep making monthly mortgage repayments.

Hi Dave, Excellent stuff, I also found this linked from the Aussie property forum today. You are spot on with your analysis and I'll follow your blog with interest.

ReplyDeleteRight now the loss is not taxed in the US. Congress changed that during the bust. It is unclear when the pols will resume this tax.

ReplyDeleteLegislation in 2007 and 2008 created an exception for qualifying cancellations of home mortgage debt during the years 2007 through 2012. Taxpayers don't need to be bankrupt or insolvent to take advantage of this provision, which allows an individual to have up to $2 million of federal-income-tax-free COD income from forgiven qualified principal residence debt. This only includes debt that was used to acquire, build, or improve a main residence and that is secured by that residence. Refinanced debt can also qualify for this exception to the extent it replaces debt that was used to acquire, build, or improve a principal residence. You must reduce the tax basis of your residence (but not below zero) by the amount of COD income that you re allowed to treat as tax-free under this exception.

I doubt it will expire in 2012. In the US we love our free lunch.

COD is cancellation of debt

ReplyDeleteanybody home?

ReplyDeleteAndy - are you still going to keep this blog up?

I noticed it has been waining a bit this year

Hi JB. Yes, I'm home - just been a bit busy with some other things. I was surpirsed that there wasn't much discussion above. Maybe it had been too long between posts.

ReplyDeleteI'd like to keep the blog going though. Any topic suggestions?

Hi Andy, Ive got a topic for you "The Housing Bubble Myth Debunked"...

ReplyDeleteYou can talk about how there's been minimal decline in property values over the last 12mths while our relatively high interest rates (by world standards) have remained stable, talk about our low unemployment rate and how the coming Infrastructure Projects Boom and Commodities Boom (MkII) will keep unemployment sub-6% with a potential low of 4% over the next 3-5yrs which should put a floor under house prices, talk about how we will need to dramatically increase skilled migration over the next few years to support these projects, talk about the unprecedented growth of our Chindia neighbours to the north which we are in prime position to capitalise on, you could mention our subsequent projected growth in ToT over then next few years which will have our cash coffers over-flowing, mention our high saving ratio, low national debt, strength of our highly regulated banking system... I could go on and on but you get the picture... Ohh! I forgot to mention, talk about when considering all the above combined with our decreasing interest rate outlook over the next 6mth then it'll be off to the races during 2012/2013.... You snooze, you loose...

Goodluck and keep up the good work!

Yes, I could title it "Buy now or miss out forever". Thanks for the laugh Anonymous.

ReplyDeleteAnonymous:

ReplyDeleteI see you still believe in the tooth fairy!?

Hi JB… Once again you’re full of talk with no counter. And no, I don’t believe in the Tooth Fairy. I believe in looking at the facts in front of me and making an educated call on that basis.

ReplyDeleteWhich of the points do you disagree with that should cause Australian house prices to increase?

There was minimal national property value declines over the last 12mths, while we’ve had relatively high interest rates by world standards?

We have a low unemployment rate of sub 6% which should continue into the foreseeable future?

The Infrastructure Projects Boom and Commodities Boom will require an increase in skilled migration?

Chindia continuing to grow strongly (+7%) increasing demand for our commodities?

Our ToT should have lots of cash sloshing around over the next few years?

We have a high savings ratio, low national debt, highly regulated banking system?

Once interest rates start to decrease this should cause property prices to increase?

Don’t forget governments around the world printing money and diluting currencies that will soon be unleashed causing real asset prices to increase dramatically via inflation… Properties partner in crime.

They all sound pretty bullish for the property market to me…

That is unless we have a deflationary Black Swan Event… Then all bets are off with the collapse of the banking system and the crash in property prices will be the least our concerns. Then people like you will no doubt be forced into prostitution to feed your family. That should be your main concern.… A slim to remote possibility I guess.

Anon

ReplyDeleteIf you even had an elementary grasp of the exponential function it would be obvious why the continued ramping of property prices cannot continue

http://www.youtube.com/watch?v=F-QA2rkpBSY

take a look and then apply to projected property growth and wage growth, do the math

Pete, people like you and JB think you know what you're talking about but all you really know is enough to be dangerous to yourselves... Which is sad.

ReplyDeleteThe purchasing power of currency is not static. It is constantly being devalued through money printing and inflation. You need to be on the correct side of that trade otherwise you will be slaughtered...

Choose asset classes that outperform during inflationary times 'cause it'll be here before you know it... Governments will ensure any potential deflationary blip showing up in the data will be nipped in the bud by throwing wads of money at the problem and they will overshoot...

Please read a book and get educated on the subject otherwise you might as well be holding JBs hand while doing dirty deeds during his deflationary crash... Good luck with that.

Andy

ReplyDeletePlease save us from the morons here like Anon and please post more of your insightful articles which cut through all the crap!

cheers

JB

Hey Andy,

ReplyDeleteHave you quit this rant already? Im still interested to see how you think this thing is about to play out. I believe my profecy is about to unfold... Hard assets are about to go on to an upward trajectory. There is at least another 50bps up the RBA's sleaves coming by mid-2013. Aussie house prices are about to shoot up very shortly.

And what about poor broke lil ol' JB?? No deflationary crash yet, how sad. However I do have a business name for you that you could use in the event it still happens....

Just Blowjobs.

Hi Anonymous. Yeah, probably finished my rant here. I think I've said all I need to say on this topic.

ReplyDeleteMy opinion about how this will play out hasn't changed - i.e. approx 40% average falls over around 7-8 years.

Not sure how JB's traveling, or why you think he's broke. But I'm sure he'll appreciate your business venture idea.

Why do I think he's broke? Beacuse all people who "want" and "preach" the system to crash are people who think they deserved better in life financially (and not morally), and they think a reset will do that for them and give them another chance... But they are wrong. They will be the people who will most suffer during a crash.

ReplyDeleteI would have thought that leveraged speculators who bought near the peak would suffer most during a crash?

ReplyDeleteLeaveraged speculators who bought near the peak and the poor would find themselves on a similar level after a crash. The middle class would be near wiped out. It would be back to a two-class society of the Haves and the Have-nots. The financially astute would be better prepared for a crash than those who are not. There are many things one can do to protect themselves during the lead up... Im not going to go into specifics here, however everyone should be aware, get themselves educated and take responcibility for their actions. The probabilty of a deflationary crash playing out is slim to remote at best. Inflation is all but guarenteed.

ReplyDelete